This is the first in an occasional series about the evolution of bank marketing.

Could it be Good Marketing?

I started the “banker” portion of my career in 1987 at Irving Trust, the smallest of the New

in 1987 at Irving Trust, the smallest of the New

York money center institutions. Three weeks after entering the training program, management recruited some of us newbies to spend weekends manning an investor relations telephone outreach effort to help the bank build shareholder support as it fended off Bank of New York’s hostile takeover attempt. After a 13 month long battle, the Irving Trust board eventually signed an agreement to “merge” with BNY to become the 12th largest bank with $42 billion in assets. Why? A line from Mr. Potter in It’s a Wonderful Life comes to mind: “I say the Building and Loan is no longer necessary to this town.” At the time, it seemed like we’d be down to 50 domestic institutions by the end of the millennium. Heck, Canada only has just 49 banks and they seem to get along fine.

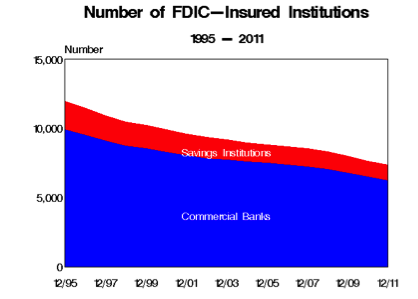

While the industry slowly continues to consolidate, shrinking by approximately 300 FDIC-insured institutions per year, we have to stop and think. Why are there still 7,083 Banks? One of the more interesting answers: Marketing.

The Role Marketing Plays

-

Marketing directs customer retention initiatives. J.D. Power and Associates recently released their annual retail banking satisfaction ratings for 2013. As you scan the regions, you'll notice that big banks with huge market shares (such as Wells Fargo and Bank of America) never top the lists. And banks that you may never experience or hear of (like Banner Bank, Bangor Savings, and Rabobank) are more likely to be on top. Does this mean most of us are more interested in surfing the web or wallpapering our closets than changing banks? Probably, but read on.

-

Marketing (including product management) designs stickiness into their products so customers can't easily leave. What's the greatest customer retention device ever invented? As a business owner, I'd have to tell you the remote deposit capture. As a consumer, it is undoubtedly online banking. My wife and I recently switched investment advisors, and our new provider offered a fantastic "no brainer" deal. No minimum balance. Use any ATM on the planet with no fees and reimbursed fees. No foreign transaction fees. No overdraft fees. Free and unlimited wire transfers. And best of all, they assigned a personal banker that would handle the entire switch for us, including mirroring our current online banking bill pay. Just sign the signature card and return it in the FedEx envelope. What would be easier? With a deal like this, or course we opened the account. It's a no-brainer. And guess what? Nine months have passed and it is still a shell account for our new bank. Why? We haven't taken the 30 minutes to assemble the account numbers and address information for our payees.

-

Marketing leads the battle for new customer acquisition. We work with clients in several industries, but there is no greater marketing challenge than convincing a perfectly unengaged and ignorant customer at the bank next door that they’ll enjoy better service, lower fees, greater convenience and even a longer life if they switch to your bank. Hell, we’ll give you $200 or more in cash on the spot just to try us out! We’re lucky we can convince one out of 100 carefully selected prospects to consider this offer. When this message is focused on the right segments, at the right time, with the right creative message and frequency, banks are able to grow their customer base.

-

Marketing is the steward of the brand. And brands have a lot of standalone value. Review Brand Finance’s interesting study that values a brand name (rather than the value of the entire organization). In 2012, Wells Fargo ranked number one with a brand Value of $23.2 billion) ahead of #2 Bank of America ($19.5 billion) and #3 Chase ($18.9 Billion—NOT including the JP Morgan co-brand valued which is independently valued at $11.6 billion.

-

Marketing leads community reinvestment efforts. Sure, we must comply with the CRA, but community outreach is a highly visible and measurable activity that make banks, including the aforementioned fictitious Building and Loan, absolutely necessary.

While one can argue state banking statues, “too big to fail,” executive greed & power, and other factors play a role in sustaining the 7,000 banking institutions we have in this country, the marketer in us all should certainly take a bow. On any given crossroad, we usually find more banks than we do McDonalds, Burger Kings, CVS’s and Walgreens combined (left out Dunkin Donuts on purpose). While our society would function a little more efficiently with the 50 banks we projected back in the late 80’s, we all have plenty of work as result, and for that, we are grateful.

![[3] Tips to Maximize Your Budget by Improving Your Bank's Targeting](https://www.bkmmarketing.com/hubfs/Businessman%20looking%20forward%20with%20binoculars%20cloudy%20background%20and%20graphs%2c%20charts%20around.jpeg)

SUBMIT YOUR COMMENT